Matual Fund

Frequently Asked Questions

A mutual fund is legally known as an Investment Company and is regulated by the Securities and Exchange Commission under the 1960 Investment Company Act.

A mutual fund is a corporation governed by a board of directors that oversee the overall operation of the fund. The mutual fund pools the funds of people with the same investment objective and risk preference as the fund and invests them for long-term capital gains, current income or both.

Being corporations, investors buy shares in a mutual fund. The daily price is called Net Asset Value Per Share (NAVPS). A mutual fund's price is published every banking day in two newspapers of general circulation. Individual mutual funds also publish their daily NAVPS in their redemption centers and, if applicable, in their websites

Mutual funds are classified according to the assets they invest in. An equity mutual fund invests primarily in stocks of companies listed in an organized stock exchange.

A bond mutual fund invests primarily in the long-term debt issues of the governments and corporations. Bonds promise to pay interest either quarterly or semi-annually and return the principal upon the maturity of the bond.

A balanced fund invests primarily in a combination of stocks and bonds.

A money market fund invests primarily in fixed income instruments that have a maturity of 1 year or less.

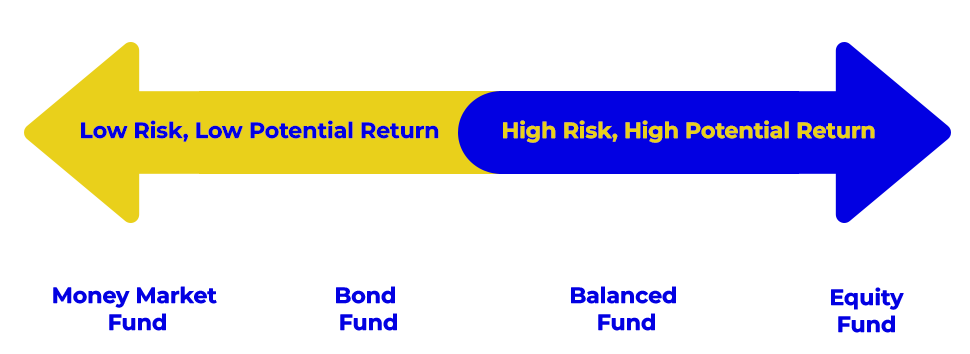

Below is the potential risk / return reward chart for investing in the different types of mutual funds:

Mutual funds can also be classified as to their entry and exits fees, otherwise known as loads, the country where they are invested as well as the currency that they are denominated.

CLIMBS is coming up with its first mutual fund in 2015 to be called the CLIMBS Share Capital Equity Investment Fund (CSCEIFC) Corporation. The CLIMBS-IMA will employ an Index +TM strategy whereby the fund will invest primarily in the component stocks of the Philippine Stock Exchange Index with some non-index stocks to provide potential outperformance.

Under the corporation code, mutual fund investors have the right to inspect the books of the corporation at any regular business hour.

Investors also have the right to nominate and vote for the directors of the mutual fund since mutual funds must have common and voting shares.

Regulations provide that the lowest initial minimum amount that a person can invest in mutual funds is Php5,000 or its foreign currency equivalent. There is no required minimum for additional investments.

The CLIMBS IMA envisions an initial minimum of Php5,000 and a subsequent minimum of only Php300 under a monthly subscription plan.

Like any other investment, mutual funds also bear risk. As shown in the previous risk/return spectrum, the risk in investing increases as the potential return also goes up.

A mutual fund minimizes the risk by diversifying its portfolio. This simply means that a mutual fund will invest is a number of instruments and /or stocks. The funds and securities of a mutual fund are also held by an independent custodian, which is a commercial bank of good repute authorized by the Bangko Sentral ng Pilipinas to perform custodian functions.

For his part, the investor minimizes his risk by holding his investments in mutual funds over the long-term. As a rough rule of thumb, long-term would mean 5 years and longer. This is why mutual funds are ideal for people planning for building their home, the college education of their children and retirement.

An investor will realize profits from a mutual fund if he sells his shares at an NAVPS higher than what he bought them at.

Mutual funds are the only type of pooled funds in the Philippines where capital gains from the sale of such funds are as exempt from capital gains tax as provided by law.

A mutual fund hires a separate company called an asset management company (AMC) that does the day to day operation of the fund. The AMC will do fund management, fund accounting (including the computation of daily pricing) and the selling of the mutual fund.

The CLIMBS-CSCEIFC will employ the services of the CLIMBS Investment Management and Advisory Corporation (CIMAC). In turn, the CLIMBS-CIMAC will rely on the expertise of the Personal Finance Advisers Philippines Corporation (PFA) not only with fund management but also in the distribution of the shares of the fund. The PFA's principals boast of over 30 years of experience in the country's fund management industry both in mutual funds and trust banking.